Rich dad poor dad was introduced to me back in the year 2008. I read it, skimmed it to get certain principles. To be precise, only two principles stuck in my head – Assets and liabilities.

Year 2019, I read the book with the intention of reading the book. My whole interest in money, finance, economics, and accounting changed with this book. This is one of the best, if not the best book on personal finance.

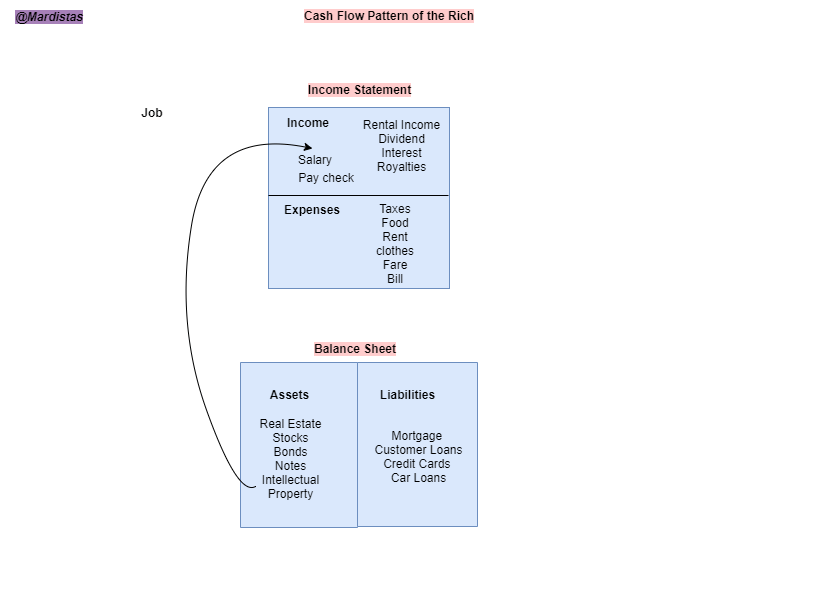

The most powerful aspect of the book are the financial diagrams. It clearly shows how money flows in a common house hold. The principles and examples are true to every human in this world.

Most useful diagram in personal finance

You get to read loads of advice on personal finance from books or the internet. Post with headlines like basic to personal finance or say 101 to personal finance.This book, rich dad and poor dad by Robert Kiyosaki is prelude to all the 101 of personal finance.

What is Personal finance?

According to your dictionary, Personal finance is defined as the management of money and other wealth resources. It also includes financial decisions for a person or a family like saving, budgeting, investments, retirement planning, taxes and insurance.

Personal finance is not only about setting personal financial goals like buying a car or building a house. But it also involves planning under financial constraints to remain debt free and fulfill those goals.

Image by Steve Buissinne from Pixabay

Personal finance is not taught in schools. So self-learning to become financially literate is so important. Basics of personal finance can be learned through books, articles, blogs, podcasts and online courses.

A persons short term or long term financial goals also comes under personal finance. A short term financial goal may be buying a car or vacation trip. Long term financial goals may be buying a house or retiring at the age of forty.

A financial literate person will be able to take decisions that will fulfill his or her short term or long term financial goals without being in debt.

Why do we need Personal Finance?

We have heard many stories of certain person earning more than average, but ended up being a broke. On the other hand we have heard stories of how poor people with hard work and determination ended being millionaires.

The question comes how they did it? Well the answer lies in personal finance. There is a common truth in bodybuilding. You can create and built a perfect body. But the hardest part is maintaining such a perfect body.

It is also true for money. You can be a millionaire, but maintaining the status of being a millionaire needs financial planning. We must understand why we need financial planning.

If you ever wanted to live a life of fulfillment, you need financial planning. Below are some of the reasons why personal finance is essential.

Personal finance is not taught in schools

There is no formal education in personal finance. Most of the countries don’t have personal finance curriculum in elementary education.

Every parent wants their children to have formal education to prepare them for their career, to earn money and have a stable life. But they don’t teach them to handle money that they will be earning.

The formal education doesn’t have curriculum about money management or wealth management. Schools teach children how to work hard for money, not how to let money work for them.

Employable age is becoming narrower

Artificial Intelligence and Automation are changing the face of industries. Jobs that require repetition or that is mechanical in nature are becoming redundant.

Employment opportunities are shifting g from countries with higher labor cost to lower labor cost. New talents are entering the work force with knowledge of new technologies that are replacing old middle age employees.

These situations make personal finance an important part of human lives. Personal finance planning helps to take care of your assets and liabilities. It will help you manage your life post retirement.

Life Expectancy Has Increased

The average life expectancy has increased from 60 to 81. Even, in developing countries, people are living longer than their forefathers. Longer life expectancy coupled with shorter employment age has made it necessary to take care of one’s retirement corpus fund and to learn about financial planning.

Medical Expenses

Many medical expenses like hospital charges, medicine are not covered by government social security systems. All these magnify the need for medical, accidental and life insurance coverage for whole of the family plus the need for emergency funds. Personal finance will cover all these areas.

Family Security

Providing financial security for your family is one of the important parts of Personal finance. Educational expenses of your children, insurance of the whole family can give you peace of mind.

Financial freedom

The most important goal of personal finance is financial freedom. You can plan out a strategy for investment, saving and budgeting which will help you to gain personal freedom. Money can’t give you happiness, but happiness can be leveraged out of money.

Personal financial planning process

You might have heard stories of people who become wealthy and on the either hand people who have become debt ridden. If you look at their life style you would find financial planning process.

Alone person has followed personal finance planning and other other didn’t. Most people have their needs and wants. Typical financial goals include things like a new car, a new home, travel and self-sufficiency during retirement life.

If you want to achieve those monetary goals, you need to plan and set priorities. Financial and personal satisfactions are results of systematic process commonly known as personal money management or personal financial planning.

Financial planning is the process of managing your wealth to achieve all economic needs and goals. Financial planning process helps you to take care of your financial situation. Every single person has a unique financial situation.

Therefore, financial planning should be done taking care of all the specific needs and goals of the individual. A well planned money management system will enhance your quality of life by reducing uncertainty about the future needs and wants.

Advantages of personal financial planning include

- It creates a system for obtaining, using and protecting your financial resources for your living years.

- It creates a system for controlling your financial affairs by avoiding debt, bankruptcy and dependency on others for your economic needs.

- It improves your personal relationships with your near ones, as you have a well-planned personal financial process.

- It creates a sense of financial freedom, as you have a personal finance system that will look after your expenses and take care of retirement goals.

The following are the six step personal financial planning process.

1. Check your current financial status.

The first step involves checking your financial situation with regard to your income, savings, living expenditure and debts.

Preparing a list of all your assets and liabilities gives you an idea of your financial state, which will help you in your financial planning.

2. Create your short term and long term financial goals.

Financial planning involves setting goals. You have to analyze your financial needs and wants. Specific financial goals are vital for financial planning.

Goals can be saving for investment or buying a car. Setting goals are important for future financial security.

3. Create alternative strategies.

Creating alternate plans are crucial for making the best decisions. Many factors will influence the alternate plans. Creativity in creating all the course of action is vital for making good decisions.

Carefully, analyzing all the alternate plans will help you make more effective decision based on your goals.

4. Examine your alternatives.

You need to evaluate the goals and plans that you have set for action. Information like economic condition, life situation, career, retirement age etc. will help you to constantly evaluate the plan of action.

Every choice has a consequence. If you chose plan A, then you close off the other alternatives. You have to make personal and financial decisions that will shape your life.

Thus, you have to accept all the lost opportunities of decision making. Relevant sources of information will help in the decision making process.

5. Create and implement an action plan.

You have to develop and implement an action plan. First, you have to setup a goal and implement it. After success, you can move to your net goal.

You can take the help of professionals when you implement your financial action plan. Example, you can take the help of insurance agent or investment brokers.

6. Assess and reevaluate your financial plan.

Financial planning is not a onetime project. You have to regularly examine your goals and action plan. External factors like job, change, migration must be assessed when you make your financial decisions.

Life event may affect your finances. Evaluating your financial planning process will help you to adjust according to the current life situation.

Personal finance principles

Planning for your finances can be a complex subject. You can get lot of information about personal finance. But finance of every individual is different and complex.

Every individual has to plan for his or her future finances or retirement plans. Financial situation of every person depends upon the pattern of income, wealth and expenditure.

About financial principles to follow. Basic financial principles can be applied in every individuals financial planning. These are some universal financial principles that you should know. The foundation of your personal finance can be built on these principles.

-

Start saving from a young age

Saving is a basic fundamental principle of financial planning. Total saving for a period are determined by the interest you earn on the saving and the time period over which you save.

If you save early than the benefits of compound interest can make you a millionaire. Compounding (compound Interest) is considered the eight wonder of the world.

-

Spend less than you earn

Spending less than your income is one of the fundamental rules of personal finance. The money that you save by spending less will help you to have a secure financial life. The more you save, the more opportunity of income you will have.

-

Pay yourself first

Every month, Set aside some amount of money for investing in monetary goals. You can pay your bills, rent and others after that.

-

Know your financial situation

Check your financial situation. Do you have single income or multiple source of income? Do you have loans, mortgage etc. before committing to any investment or expenditure you have to check your finances.

-

Built an emergency fund

Saving certain amount of many for emergency situations like medical emergency should be a priority. Having funds which can be easily withdrawn as cash can solve many emergency situations.

-

Clear your debts

Become a responsible borrower, and always clear your debts in time. Getting credit in future will be easy if you can repay in time. One of the basic rules to remember, don’t borrow what you can’t repay.

-

Create a monthly budget

Creating a monthly budget of income, savings and expenditure will help you to plan your future financial goals.

-

Keep a journal

Map your financial goals by keeping a journal. You can list all your short and long term financial goals. You can jot down all the plans for achieving the goals in the journal.

-

Stay insured

Choose your insurance plans sensibly. There are many insurance plans which are not necessary at all. Find insurance plans that will help you and your dependents in emergency situations like illness or accidents.

These are some basic financial principles that you can follow to achieve the desired financial goals. These basic rules will improve one’s financial situation.

Important books on personal finance

Books help us to learn faster about any topic. It is same with personal finance there are important books that can give you a basic idea about personal finance.

There are plenty books that talk about money and wealth. But most recommended books on personal finance are about basics like saving, investing, debt and loans.

There are many books that will help you understand the fundamentals of personal finance like

INTELLIGENT INVESTOR by Benjamin Graham

SECURITY ANALYSIS by Benjamin Graham

THE LITTLE BOOK OF COMMON SENSE INVESTING by John Bogle

WARREN BUFFET WAY by Robert Hagstrom

IRRATIONAL EXUBERANCE by Robert Shiller

THE MOST IMPORTANT THING -Howard Marks

THE ALCHEMY OF FINANCE by George Soros

RICH DAD, POOR DAD by Robert Kiyosaki

THE RICHEST MAN IN BABYLON by Richard Clason

All these books have generic fundamental principles about money that are useful to follow. The basic principles are applicable in every decision making context of life.

I have read Rich Dad, Poor Dad by Robert Kiyosaki and it has stayed with me. Some of the lessons and principles that have cleared my mind about money and finance are mentioned in this famous primer on personal finance.

The main principles are:

- Invest in your skills and knowledge.

- Invest in income generating assets.

- Job is not your business

- Leverage corporations for tax savings.

- Don’t work for money; let the money work for you.

The most amazing thing about the book is the simple illustration of financial concepts through diagrams. The simple diagrams help you to understand the concepts and principles in a simple way.

The cash flow diagram helps you to understand how your hard earned money flows. It helps you to understand why you are unable to save money. It helps you to understand why you are not a wealth magnate.

Cash flow diagram from rich dad poor dad

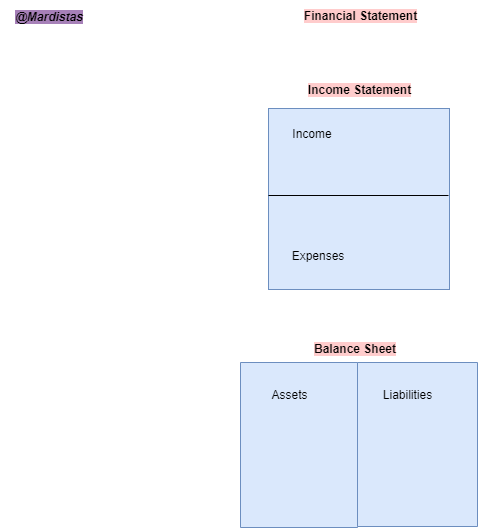

Financial statement of every individual look like this:

Income statement: Income and expenditure

Balance sheet: Assets and Liability

A financial statement is a document that outlines a person’s financial position at a particle time. It usually has two sections: Balance sheet and an income statement.

In basic terms, Income statement gives the position of your money movement (cash flow- cash in and cash out). Cash flow can be in the form of salary, paychecks as income and food, insurance, internet as expenditure.

Balance sheet gives the position of your stock of wealth. Wealth can be in the form of assets like stocks, shares, real estate and liabilities like credit card, loans, mortgage etc.

Below diagram describes the Financial statement of individuals.

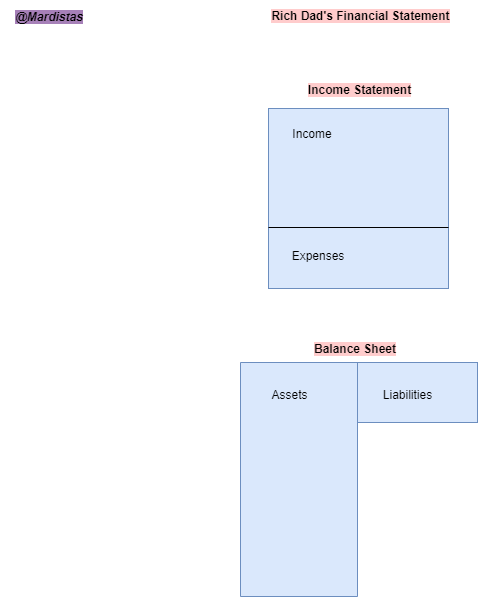

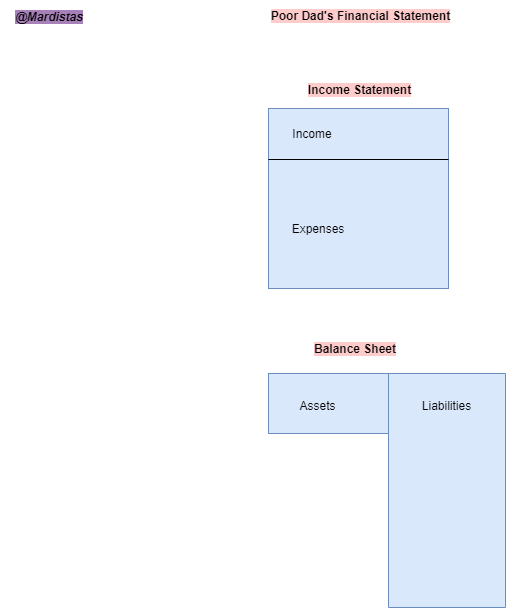

According the Robert Kiyosaki, the financial statement of rich is different from the poor. Rich dads have higher income and lower expenses. Their balance sheet has more assets than liabilities.

Poor dad’s income statement has low income with higher expenses. And there balance sheet shows few assets and more liabilities.

Cash Flow: Cash Flow can be defined as the amount of money that flows in and out for a specific period of time. Cash inflows can include salary, interest, dividends and royalties.

Cash inflows are anything that brings in money. Cash outflow includes rent, mortgage, gas, loans payments, debts, groceries etc. It represents all the expenses.

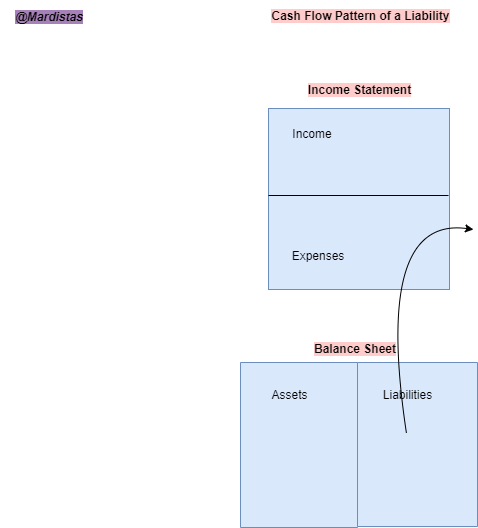

Below drawn diagram show the cash flow pattern of a liability. A liability usually creates expenses (Cash outflows)

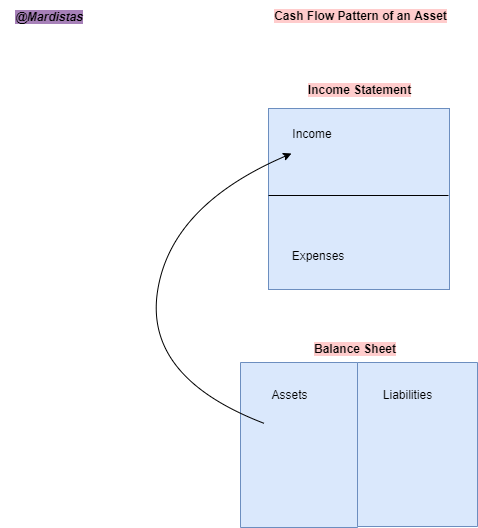

Below diagram show the cash flow pattern of an asset. An asset usually creates income (Cash Inflows)

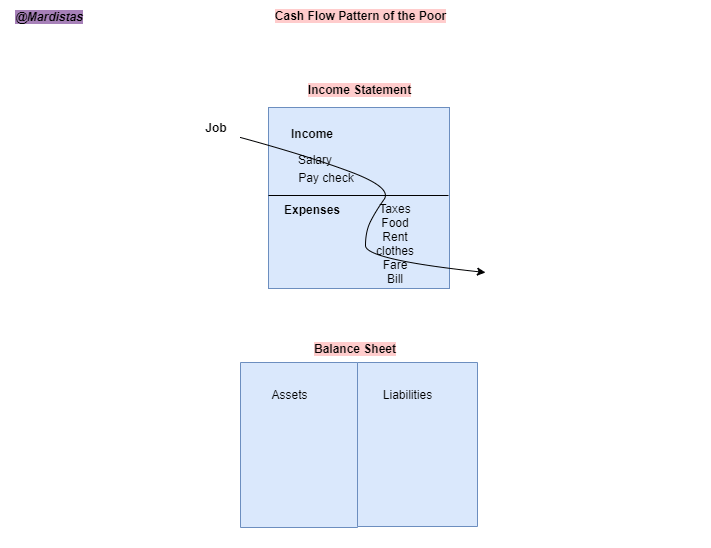

Below diagram shows the cash flow pattern of the poor. The poor usually spends all of their income in expenses. They spend all of their cash inflows in expenses like rent, bill, amusement, food etc.

They don’t save their income for creating assets like savings accounts, insurance policies and real estate. They usually end up living in debts. The poor and the middle class don’t create assets which in turn will create multiple source of income.

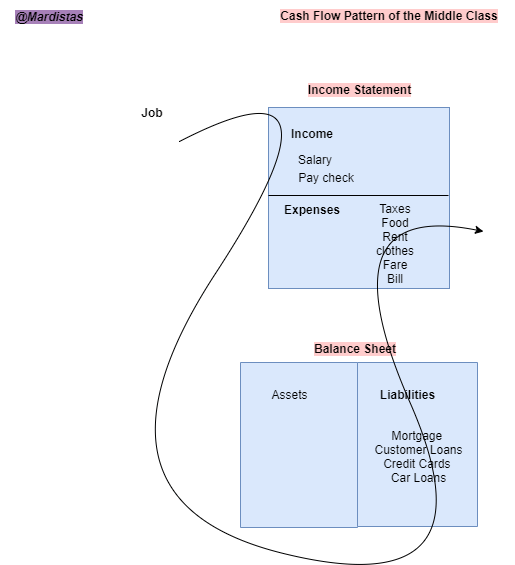

Cash flow pattern of the middle class is similar to the poor. The middle class has higher income than the poor; but they have the same mind set of not creating assets. The middle class buys liabilities that usually end up in expenses.

The rich people start with buying assets which in turn creates multiple incomes. The rich have less liabilities and expenses.

They iterate the process of buying assets which will create further source of income. The ultra-rich lives a simple life with more assets than liabilities.

Rich dad poor dad by Robert Kiyosaki is one the most recommended books for personal finance. It explores the fundamentals of money, wealth generation etc.

The simple diagram used in this book helps you understand the concept of cash flow. How money flows in and flows out in a common household.

The book is recommended for youngster who is starting their career. You can gift it to your friends and family members. Parents can gift this book to their children.

The book will help youngsters to understand the concept of money, how money comes in and goes out. This book will clear the difference between money and wealth.

If you like the article subscribe to our monthly newsletter.